Crisis Management in the EU Competitive Market – The Case Law of the Court of Justice of the European Union

Air transport is one of the sectors most affected by the disruptions caused by the COVID-19 crisis. As a result of the government's response to the effects of the crisis, the trend towards increased competition in the sector in recent decades seems to have been reversed, at least temporarily, mainly by strengthening the market position of larger companies owned by or of strategic importance to the state. This paper presents a methodological example for examining the expansion of the state's role in a particular regulatory area. More specifically, it examines how the impact of the COVID-19 crisis can be measured in the evolution of ECJ case law on the legality of state aid.

Introduction

The Court of Justice of the European Union (hereinafter CJEU) has played a role in all of the major crises afflicting the European Union (hereinafter EU) over the past decade (Conant 2021).[1] The CJEU has had to rule on a number of disputes linked to a crisis such as those affecting the economic and financial situation in 2008, the Eurozone, democratic backsliding, migration, Brexit, the COVID-19 epidemic and Russia's aggression in Ukraine.

This paper presents the partial results of a three-year comprehensive research project.[2] The hypothesis of the research is that the regulatory role of the state in various forms (exclusive rights, ownership, subsidies, etc.), both in Europe and outside Europe, has expanded significantly over the last decade and a half, mainly following the 2008 crisis and then in the context of the fight against the coronavirus crisis. In addition, the relevant EU internal market and competition rules have become more permissive (Horváth & Bartha 2018; Bartha & Horváth 2022; Horváth 2016; Horváth 2018). The research aims to examine these developments mainly in the context of public services in the EU Member States, in particular on the basis of the case law of the CJEU. The main research question is to what extent can the process of expansion of public roles be seen as a specific outcome of the crises of the last decades (the 2008 crisis, the climate change transition to a climate crisis, and the coronavirus crisis starting in 2020), or to what extent are they independent of all these effects.

This paper is a methodological example of an attempt to answer this question in a particular regulatory area. More specifically, it will be examined how the impact of the COVID-19 crisis can be measured in the evolution of the case law of the CJEU on the legality of state aid.

1. Regulatory background

Prohibition of State aid having a distortive effect on the operation of the internal market is among the fundamental rules of European integration. As a main rule, Article 107(1) of the Treaty on Functioning of the European Union (hereinafter TFEU) provides that “any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or the production of certain goods shall, in so far as it affects trade between Member States, be incompatible with the internal market”. Article 107 (2) and (3) provides exceptions to the general prohibition by defining categories of acts that are or can be regarded as compatible with the internal market, further detailed rules on exemptions are laid down in secondary legislation (see Table 1 below).

In the European Union, a strict control mechanism has been established in order to filter State aids falling under the prohibition of Article 107 TFEU. In accordance with Article 108 TFEU, all new aid measures must be notified to the Commission, i. e. the main authority being responsible for reviewing the legality of State aids, in advance[3] and Member States must wait for the Commission's decision before they put the measure into effect. There are, however, certain exceptions to mandatory notification. If the Commission considers the State aid measure incompatible with the internal market, it will require the Member State to recover the aid from the beneficiary. The decisions of the Commission may be challenged before the CJEU. If the state concerned does not comply with the Commission’s decision within the prescribed time, the Commission or any other interested state may initiate an infringement procedure against this state [Article 108(2) TFEU]. Article 107 TFEU or Commission decisions may also be subject to preliminary ruling procedure under Article 267 TFEU. Article 107 TFEU may be directly invoked before the judicial forums of the Member States and national courts also play an essential role with respect to recovery of unlawful aids.

Article 107 TFEU also sets up a system of exemptions, based on specific legal grounds. These include aid that can be established without specific assessment (1) and aid that can be designated as such by specific decisions but on a discretionary basis (2) (Horváth et al. 2023).

(1) In the former context, Article 107 TFEU distinguishes between aid declared compatible with the common market and aid which, by virtue of its classification, does not distort competition. The items of aid falling within this category are (a) aid having a social character, granted to individual consumers; (b) aid to make good the damage caused by natural disasters or exceptional occurrences; (c) aid granted to the economy of certain areas of the Federal Republic of Germany affected by the division of Germany [see Article 107(2) TFEU].

(2) The second category is the aid which is compatible with the internal market on the basis of the Commission's discretionary decision. The subcategories are: (a) aid to promote the economic development of areas where the standard of living is abnormally low or where there is serious underemployment; (b) aid to promote the execution of an important project of common European interest or to remedy a serious disturbance in the economy of a Member State; (c) aid to facilitate the development of certain economic activities or of certain economic areas; (d) aid to promote culture and heritage conservation; (e) other categories of aid as may be specified by decision of the Council of the European Union.

The majority of state aid measures has been adopted on the basis of Article 107(2)(b) and 107(3)(b) TFEU. In the earlier decades of the European integration, the „remedy a serious disturbance” exemption had been applied only a few times, but this practice has changed when the 2008 economic crisis hit Europe (Rosano 2020).

After the wake of the global financial and economic crisis of 2008, the Commission assessed, within one year, over 100 national schemes or measures to support financial institutions under EU state aid rules (Lowe 2011). The Commission also adopted its first Temporary Framework (Commission 2009), as well as communications and regulations in order to allow member states to grant certain types of aid to structurally weak companies and those facing a sudden shortage or unavailability of credit in order to reduce the negative effects of the crisis. According to the Commission’s view, global crises like the one of 2008 or the COVID-19 pandemic and the ongoing Russian–Ukrainian war required (and still require) exceptional policy responses such as the “remedy a serious disturbance” exemption. These measures left more room for member states to grant state aid in those sectors that are affected by the negative economic consequences, even indirectly (Bartha & Horváth 2022).

In March 2020 the Commission adopted the COVID-19 Temporary Framework (Commission 2020), based on the authorization in TFEU to allow Member States to take exceptional state aid measures to remedy a serious disturbance across the EU economy. The Framework allowed for a wider-than-usual granting of State aid, but on condition that a number of specific requirements were met (Creve & Gaarslev 2023).

The present study examines the legal assessment by the CJEU of state aid schemes in the aviation sector adopted under the „crisis exemptions” of Article 107 TFEU and the COVID-19 Temporary Framework. Specifically, the analysis focuses on those schemes notified by Member States to the Commission, and whose legal assessment decisions were subsequently challenged before the CJEU in the context of annulment proceedings. The choice of the air transport sector was explained in particular by the fact that it was the sector which was the main target of the challenges to the Commission decisions in the first two years of the epidemic and therefore the sector for which we currently have a sufficient number of court cases.

The state aid schemes subject to this paper have been collected from a specific state aid dataset[4] developed from data in the Commission's competition law database.[5] Based on the schemes identified this way, the relevant judicial decisions have been selected from the case law database of the CJEU.[6]

2. The Case Law of the EU General Court

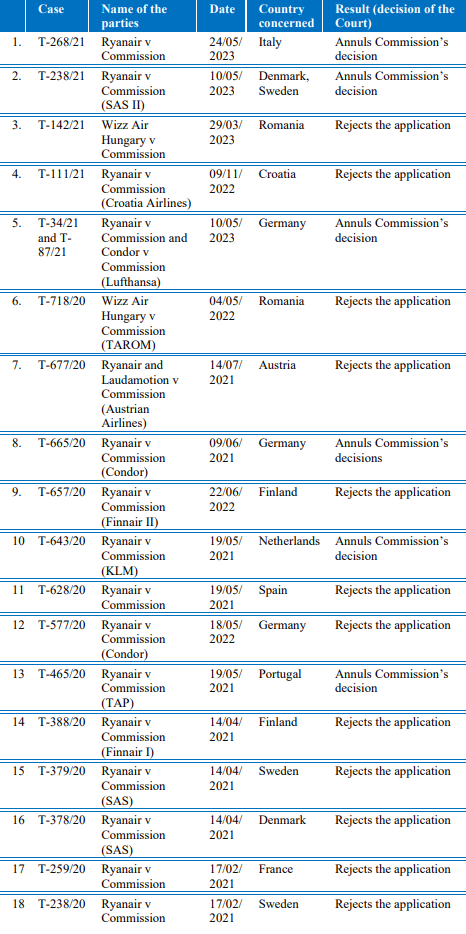

The basic data of the selected court cases and the outcome of the decisions are summarised in Table 1 below.

Table 1: Judgments of the CJEU on the legality of COVID-19 aid measures in the aviation sector

Source: author’s compilation based on data from CJEU Competition Law database

During the first half of 2020, the measures taken to control the spread of the coronavirus disease caused major disruptions in economic activity. Air transport was particularly affected, with a 50% decrease in the total number of flights worldwide (and more than 90% in some countries) in April and May 2020 (Abate et al. 2020; Commission 2020). To mitigate the negative impact of revenue losses, several countries, including EU Member States, have provided financial support to national airlines and other actors in the aviation value chain (Abate et al. 2020). These measures mainly aimed at ensuring essential connectivity, security of supply during the pandemic and preserving jobs in the industry (Abate et al. 2020; OECD 2021; Tuiminen et al. 2022).

The active role of the two airlines (in particular Ryanair the largest privately owned listed airline in Europe, see OECD 2021, 10) as plaintiffs (see Table 1) is mainly explained by the fact that the majority of crisis state aid granted by Member States in the air transport sector went primarily to airlines which were State-owned or of strategic importance to the government, but which were also the main competitors of the plaintiffs in the provision of passenger transport services from European airports.

In the contested decisions, the Commission declared all the state aid schemes subject to the CJEU cases listed in Table 1 to be lawful, i. e. compatible with the EU internal market. In 12 out of the 18 judgments, the General Court found that the decision at issue complied with the relevant substantive and procedural rules of the European Union, and, as Table 1 shows, annulled the Commission's decision in only 6 cases. Of the 6 cases, only 2 decisions were on the merits, in the other 4 cases the Court concluded that the Commission's decision should be annulled for breach of the obligation to state reasons, and in 3 of these decisions the annulment was also suspended pending a new decision by the Commission, which means that the implementation of the aid scheme can start.

Thus, the General Court held that the Commission's decision did not comply with EU state aid rules on the merits in only 2 out of 18 cases. It is worth taking a closer look at these decisions. In these cases, unlike in the other cases, Ryanair (and Condor) based its appeals, on the Commission’s failure to comply with the provisions of the Temporary Framework (Nicolaides 2023).

In its judgment delivered in the case Ryanair v Commission [SAS], the General Court ruled that the Commission’s decision to approve Danish and Swedish state aid to SAS in 2020 in connection with the COVID-19 pandemic was unlawful. The critical point of the state aid scheme (a recapitalisation measure) was that Denmark and Sweden had not sufficiently ensured that SAS would have an incentive to buy back the shares acquired by the Member States once SAS had overcome its financial difficulties. The Temporary Framework, however, requires that if the aid in question constitutes a recapitalisation acquiring shares in the company, then the Member State must exit the company as soon as possible once the company has regained financial stability (Commission 2020a, Creve & Gaarslev 2023). The General Court, in agreement with Ryanair’s application, argued that the Commission had failed to justify “the direct application of Article 107(3)(b) TFEU and a derogation from the provisions of the Temporary Framework requiring the inclusion of a step-up or alternative mechanism as regards equity instruments.” (Ryanair v Commission [SAS], para. 80).

In joint cases Ryanair v Commission and Condor v Commission [Lufthansa], the Court reached the same conclusion stating that, in the contested state aid scheme, the calculation of the price at which the state acquires shares upon entry into the beneficiary’s capital did not constitute an alternative set-up mechanism in the meaning of the Temporary Framework to provide an incentive to buy back state’s shareholding as quickly as possible. The Court also established that the Commission had not assessed whether the beneficiary would not have been able to obtain financing on the market at affordable terms which is a precondition for granting state aid in the form of recapitalization under the Temporary Framework. The General Court also found that, when assessing the potential risks of distortion of competition resulting from the contested aid, that the Commission failed to assess correctly whether DLH held significant market power at main airports other than Frankfurt and Munich, such as Düsseldorf and Vienna, thereby infringing the provisions of the Temporary Framework.

Conclusions

Air transport is one of the sectors most affected by the disruptions caused by the COVID-19 crisis. Most governments gave a high priority to maintaining air transport connectivity in order to protect economic activity and jobs, not only in aviation itself but also in related sectors such as tourism (Abate et al. 2020). This implies, on the one hand, a limitation of the importance of the policy priorities that shaped the evolution of the air transport sector before the crisis, especially those related to climate change and environmental protection (Abate et al. 2020). On the other hand, the development towards increased competition in the sector in the last decades seems to be reversing, at least temporarily, mainly strengthening the market position of larger companies that are state-owned or of strategic importance to the state.

The sectoral case study and related legal analysis presented above, as opposed to the method of analyzing a specific "leading case", provides an opportunity to assess the main trends and specificities of the whole body of case law related to a particular challenge in a given sector, taking into account the relevant legal and policy context. As a result, we can see that the Commission has essentially accepted the Member States' changed policy priorities in the aviation sector due to the crisis and their state aid measures constituting stronger public intervention. The case law of the CJEU has not fundamentally changed the Commission's practice, but there are several examples where the CJEU has required Member States to comply with the conditions laid down in the Temporary Framework (despite its soft law nature) more strictly than the Commission, i.e. the creator of the Framework, itself.

For a list of references, click HERE.

Author: Ildikó Bartha, Associate Professor of Law, University of Debrecen, Faculty of Law and Political Studies

[1] The present paper was Supported by the ÚNKP-22-5 New National Excellence Program of the Ministry for Culture and Innovation from the source of the National Research, Development and Innovation Fund.”

[2] I.e. the research project of the author entitled “Versenypiac vs. válságkezelés? Szabályozási kihívások az Európai Unióban” [Competitive market vs. crisis management? Regulatory challenges in the European Union] supported by the János Bolyai Research Scholarship of the Hungarian Academy of Sciences.

[3] Otherwise they are declared as 'unlawful aid' if the Commission receives information on such aid granted without its prior authorisation.

[4] Dataset of the project K 134499, K_20 ‘OTKA’ NKFI Found, National Research, Development and Innovation Office (Hungary) (hereinafter OTKA/NKFI database).

[5] https://competition-cases.ec.europa.eu/search (hereinafter Commission Competition Law Database).

[6] https://curia.europa.eu/jcms/jcms/j_6/en/ (hereinafter CJEU Case Law Database).